Resource Library

All of Reveel’s resources, in one place.

- Filters

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}

With quick growth comes quickly growing expenses. The KNIPEX team has partnered with Reveel for several years to maintain a strategic eye on their data and keep their shipping costs low.

Canada Border Services Agency launched their CARM Initiative with Release 1, which highlights their CARM Client Portal (CCP). With CCP, the collection of duties and taxes can now be done online through the portal.

Hear about Reveel’s journey from Chad and Josh, learn about the new platform, and get their predictions for the future of the shipping industry.

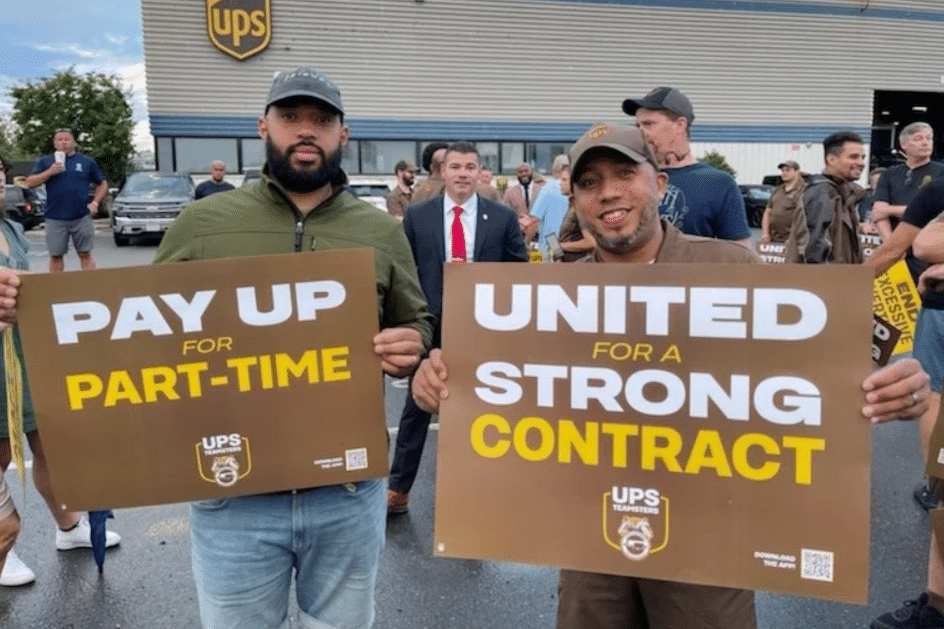

After lengthy negotiations, Redcat Racing ultimately stayed with UPS. They were able to drastically reduce their dimensional weight, saving them over $53,000 in annual shipping costs.

Today, April 5, 2021, UPS has officially begun the process of reinstating the Service Guarantee across their organization after over a year of its suspension. Currently, the Service Guarantee applies to all UPS Next Day Air services and UPS Worldwide Express services with the guaranteed delivery time extended to end-of-day for UPS Next Day Air Saver®.